November 2020 Jobs Report: 245,000 Jobs Added

Job growth in November slowed in the U.S., according to the Labor Department’s monthly Jobs Report. Last month, employers added 245,000 jobs, a stark difference from October’s 610,000

November 2020 Jobs Report: 245,000 Jobs Added

Job growth in November slowed in the U.S., according to the Labor Department’s monthly Jobs Report. Last month, employers added 245,000 jobs, a stark difference from October’s 610,000

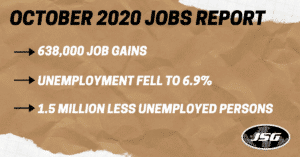

October 2020 Jobs Report: 638,000 Jobs Added

According to the Labor Department, U.S. employers added 638,000 jobs last month, much than economists projected. This is the sixth month in a row of

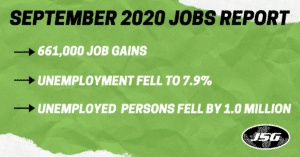

September 2020 Jobs Report: the U.S. Gains 661,000 Payrolls

The Labor Department reported that nonfarm payrolls rose by 661,000. That is the fewest gains since May and much lower than economists’ expectations of around

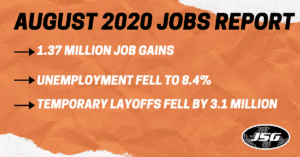

August 2020 Jobs Report: 1.37 Million Jobs Added

For the fourth month in a row, the U.S. economy experienced a growth in jobs and a decline in the unemployment rate. In August, the Department

August Jobs with the Fastest-Growing Demand

As the country continues to recover, jobs are starting to return faster than many economists projected. The Labor Department reported a gain of 1.8 million jobs last